I often hear concerns from clients about the Premium Tax Credit (PTC) and the problem of making too much money. And indeed, there can be significant tax implications depending on your annual income!

A little background on the Premium Tax Credit

The Premium Tax Credit (PTC) is a provision of the Affordable Care Act (“Obamacare”) allowing for federal subsidies to individuals and families purchasing health insurance through the Health Insurance Marketplace (the Marketplace).

These subsidies take the form of Advanced Premium Tax Credits (APTC). APTC is paid to your insurance provider. A refundable credit may also be available to you when filing your annual tax return.

A refundable credit reduces tax liabilities, dollar-for-dollar, and may result in a cash payment that is directly paid to you! This contrasts with a “regular” credit which is only a direct reduction in taxes due.

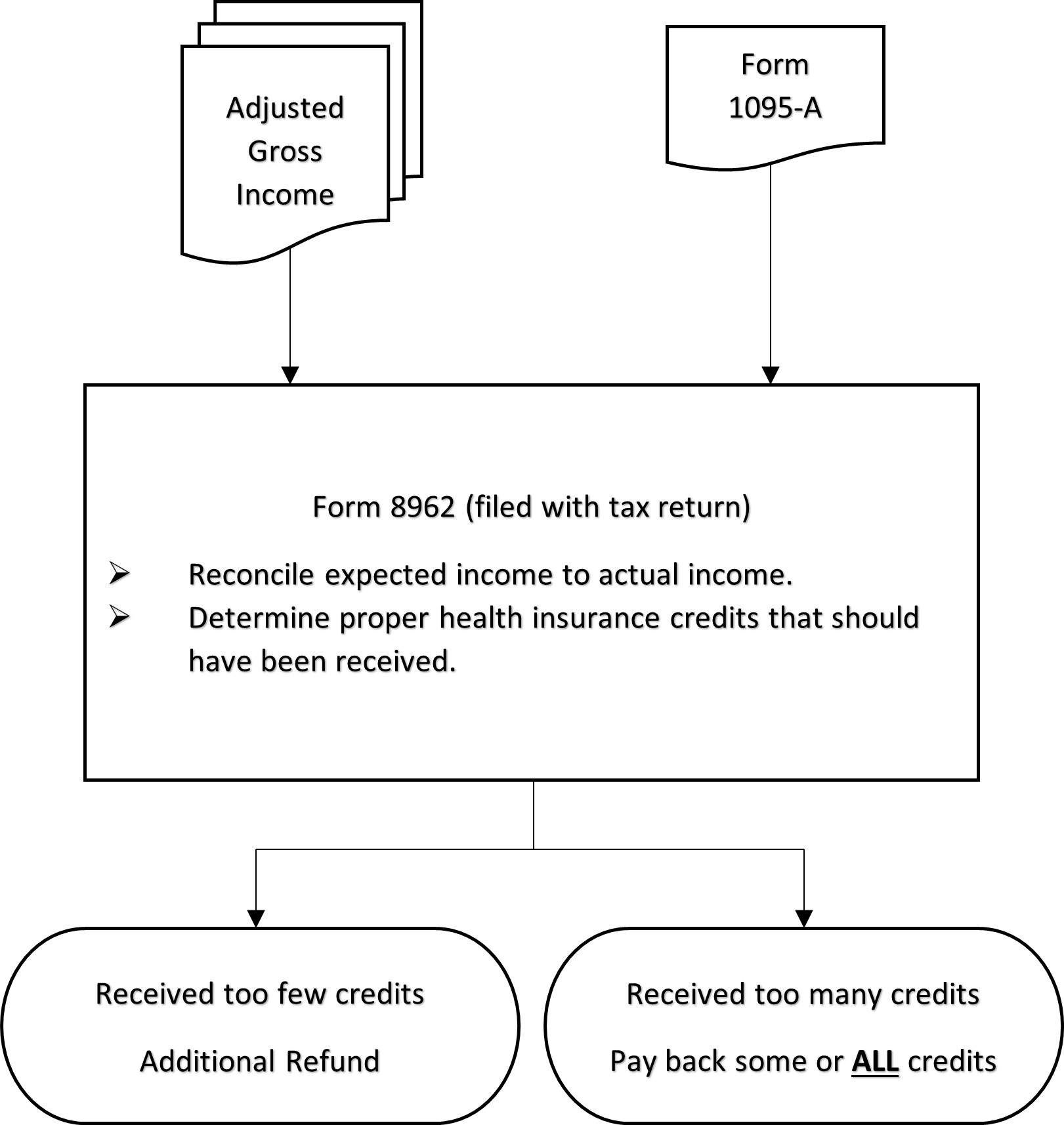

When enrolling, the Marketplace determines your eligibility for the advanced payments which results in discounted health insurance. Part of this enrollment process involves estimating your expected income for the current year. Unfortunately, as you well can appreciate, predicting the future is a tough business. So, at year end, a reconciliation is performed between estimated income and actual income. This will determine if you received too much or too little health insurance credits.

This is the point where your CPA becomes involved.

IRS Form 8962

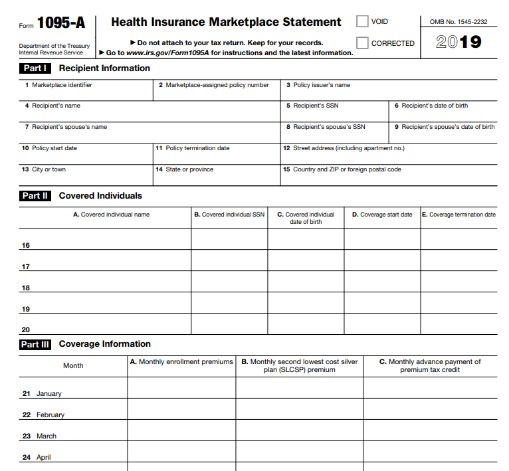

Form 8962 is filed along with your annual tax return. The IRS uses this form to reconcile expected income, actual income, and health insurance subsidies. Besides form 8962, which your CPA handles, the other half of the reconciliation involves form 1095-A.

The Marketplace provides this form 1095-A to you. Form 1095-A shows the months of health insurance coverage purchased through the Marketplace along with any Advanced Premium Tax Payment (APTC) paid to your insurance company. The CPA then compares the amount of APTC actually paid to what should have been paid based on your final income.

You may have to pay it back!

Long story short, if you earn more income than indicated at enrollment, you may have to pay back some or ALL the APTC. Conversely, if less income is earned, you may get a bigger return in the form of a Premium Tax Credit.

Chances are that you will face one of these two outcomes… Unless you are one of the few that manages to accurately predict your annual income.

While this may all seem straight forward, nothing is ever so simple with the IRS. There are many rules, exceptions, and caveats that exist in connection with the Premium Tax Credit…

Understandably, it is easy to get overwhelmed!

As we approach the automatic due date for filing your individual tax return (Yep. It’s due October 15th), AWICPA will gladly help you file your annual tax return and get a plan together for next year’s return.

Call today, before all our appointment schedule becomes full, and make an appointment to get your tax return prepared.