What is Prepaid Revenue?

Prepaid revenue occurs when businesses charge clients, and are paid, upfront for services they will perform for months to come.

For example, many Software as a Service (SaaS) businesses often receive payment today for services they will provide over the next 1, 2, or 3 years.

Money now versus money later is typically a good thing. However, this situation could cause some accounting headaches.

Prepaid Revenue Headache

The problem businesses with prepaid revenue run into is spreading this prepayment over future periods of service.

Theoretically, the process is simple to understand. If a client pays you $1,200 for 12 months of future service, the monthly revenue is $100 per month for the next 12 months.

However, the headache with this prepaid revenue involves how to enter this into your accounting system with the least amount of work possible and with the best results.

Below I have outlined a procedure to setup this prepaid revenue and allocate it on a monthly basis in QuickBooks Online.

In the following example, I create a new client named Bob Smith who is going to pay $1,200 today with the promise that he will receive a software subscription service over the next 12 months.

Step 1: “Unearned Subscription Revenue”

First, we need to create a new liability account called, “Unearned Subscription Revenue.”

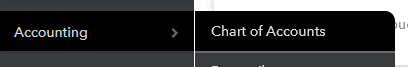

After logging into your QuickBooks Online account, on the left menu screen, click on “Accounting” and then “Chart of Accounts”

Then, click on the green “New” button, near the upper right-hand corner of the screen, to create a new account.

Below is an example of how I set up this new “Other Current Liabilities” account on the balance sheet. Click on the green “Save and Close” button on the lower left-hand side of this new account pop-up screen.

Step 2: New Prepaid Revenue Item

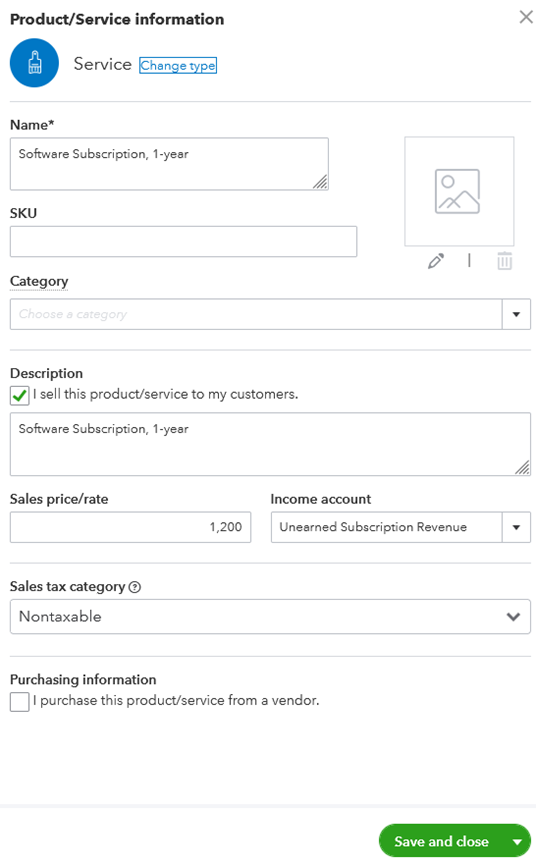

The next step in this procedure is to create a new service item for the prepaid revenue.

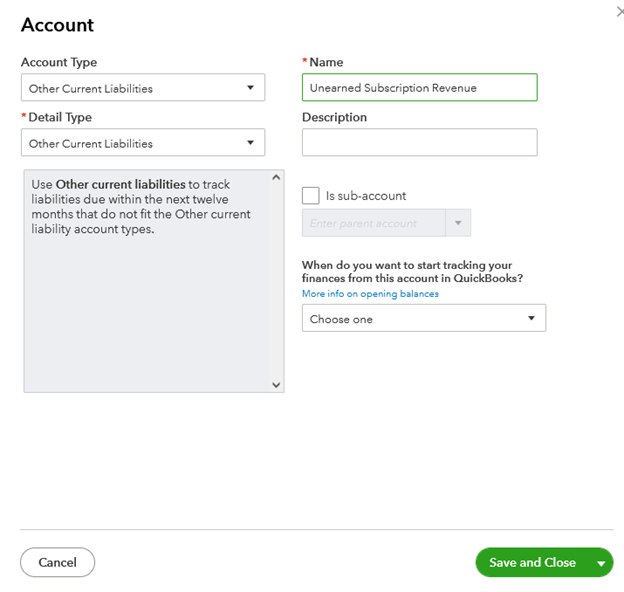

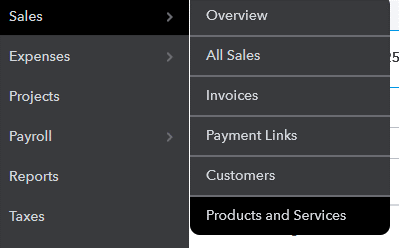

Click on “Sales” and then click on “Products and Services.”

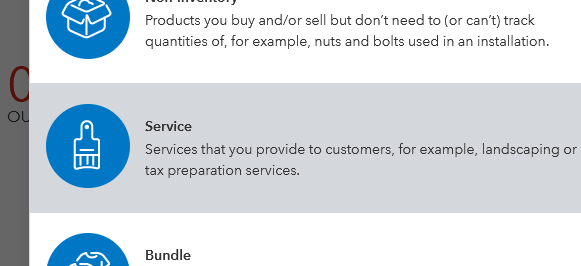

Then click on the green “New” button in the upper right-hand corner.

Now select “Service” from the menu that appears.

The name I came up with for this item is “Software Subscription, 1-year.” You may want to be more specific depending on the variety of services you provide.

Keep in mind, this item may be something your client will see on their invoice so make sure the name is appropriate and informative.

Also, make sure the account used in the “Income” box is “Unearned Subscription Revenue.” This is important because we want to make sure this payment is NOT recorded as income on your income statement… At least not yet.

Click on the green “Save and close” button at the bottom of the screen when you have this new item setup.

Step 3: Create Prepaid Revenue Invoice

Here is how to quickly create an invoice for the client using the new service item you just created in QuickBooks Online.

Click on the “New” button at the top of the left-hand menu and select “Invoice.”

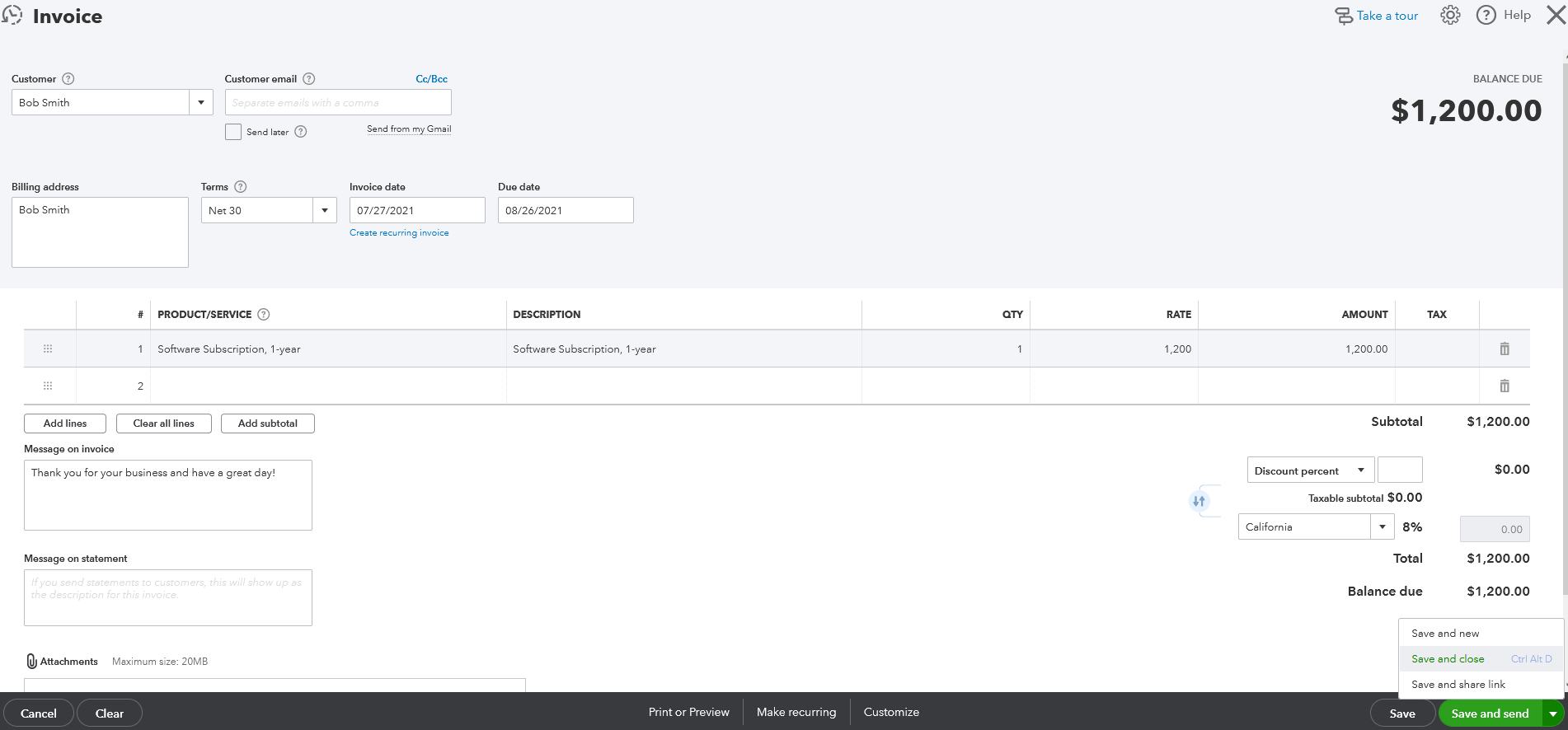

Below is the invoice I created using the newly created service item.

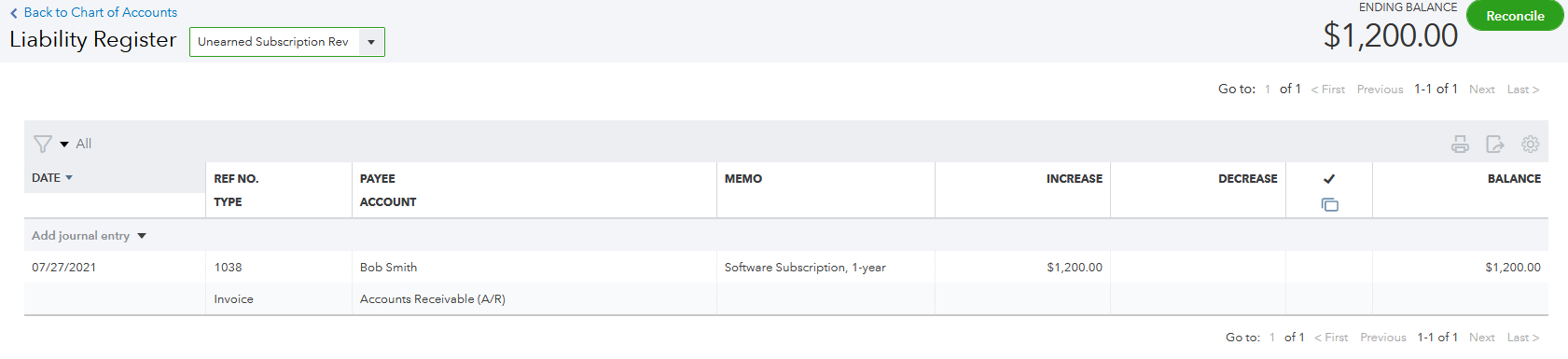

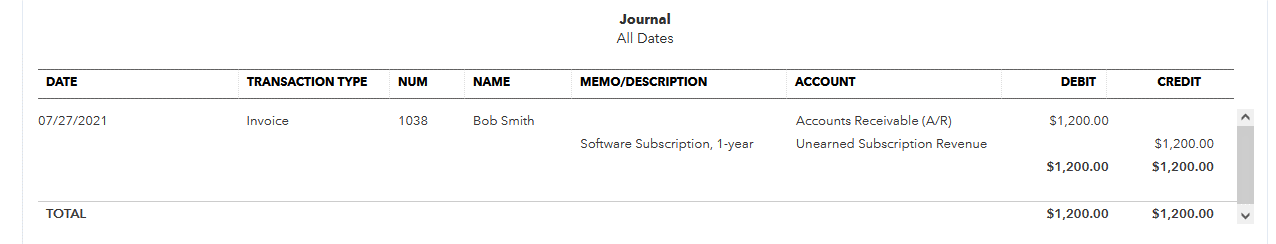

We will see that there is now a balance of $1,200 in the “Unearned Subscription Revenue” account that is associated with Bob Smith.

You will receive payment against this invoice as normal. As you can see in the image below, the invoice created a receivable for $1,200 from Bob Smith with an equal credit to the “Unearned Subscription Revenue Account.”

Step 4: Spreading Out Monthly Revenue

Here comes the issue most business have, “How do I recognize income on a monthly basis as it is earned?”

The cool part is that QuickBooks online can be set-up to easily, and automatically, to relieve the “Unearned Subscription Revenue” account monthly.

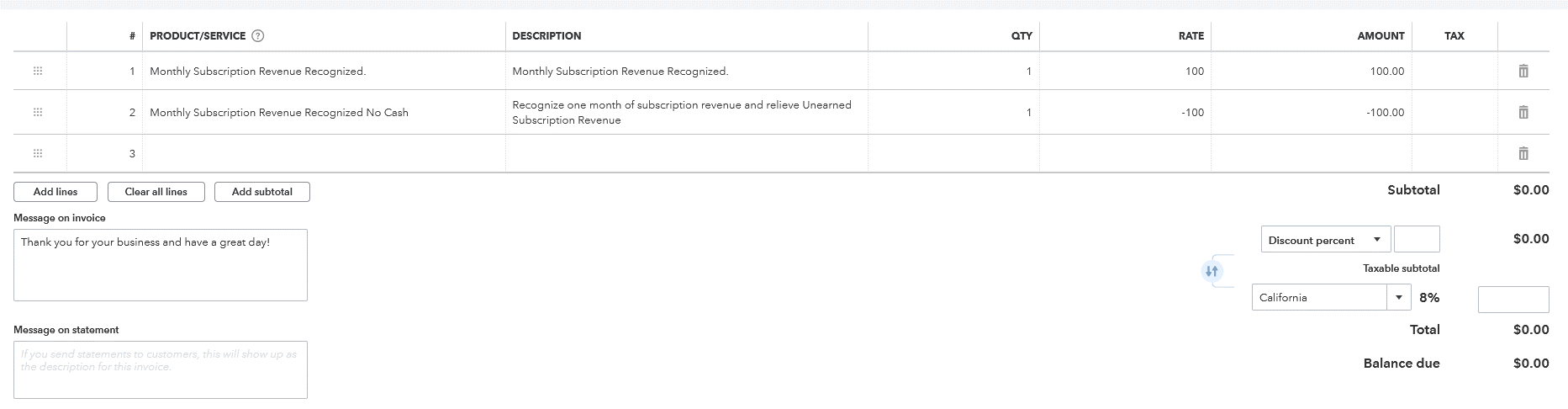

We will accomplish this by creating a recurring, Zero Dollar, invoice using two more new items. Here’s how it is done.

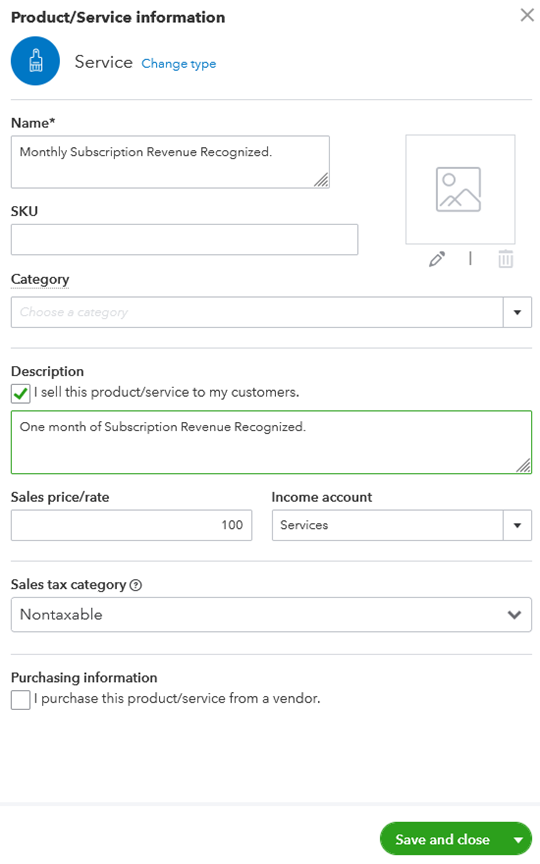

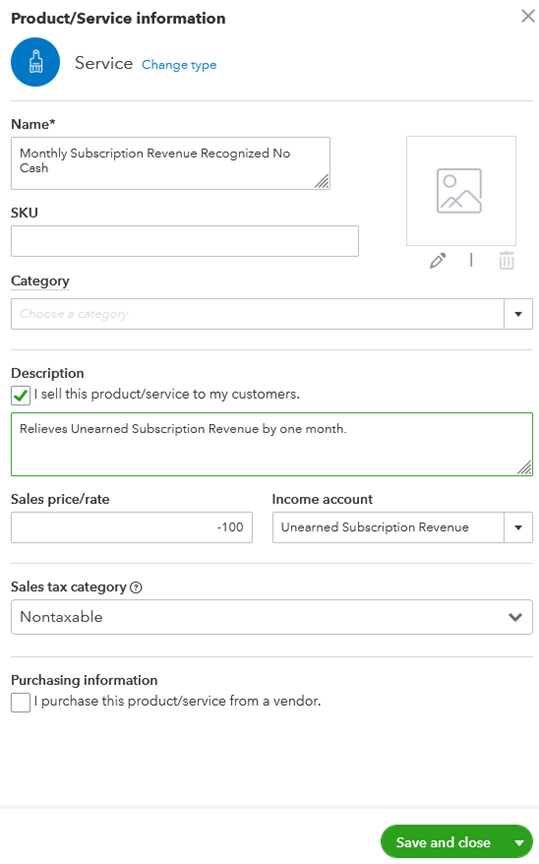

Create two new service items. I called the first one, “Monthly Subscription Revenue Recognized.” The second one is “Monthly Subscription Revenue Recognized No Cash.” Both are service type items and are nontaxable. (see images below)

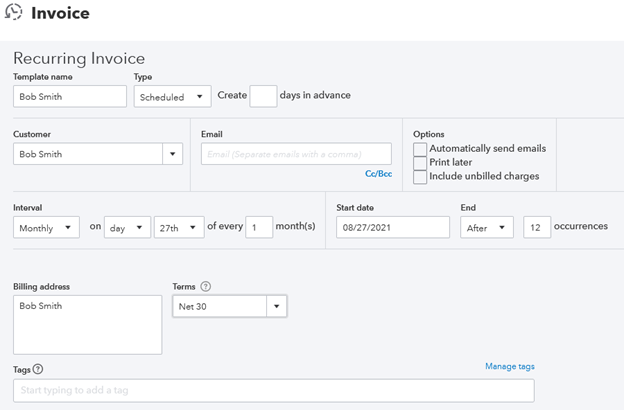

Step 5: Create Recurring Zero Dollar Invoice

The next step is to create a Zero Dollar recurring invoice using these two newly created items.

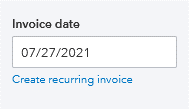

Create a new invoice just as before, but this time click on the “Create recurring invoice” link under the “Invoice date” field.

This will open a plethora of new options for your invoice. I have set this invoice to automatically post exactly one month from today and to end after it has posted 12 times.

We do NOT want this invoice to be printed or automatically emailed in the future so make sure none of the “Options” have been selected.

The first item on the above invoice credits income for $100. The second item reduces the balance in the “Unearned Subscription Revenue” account by $100.

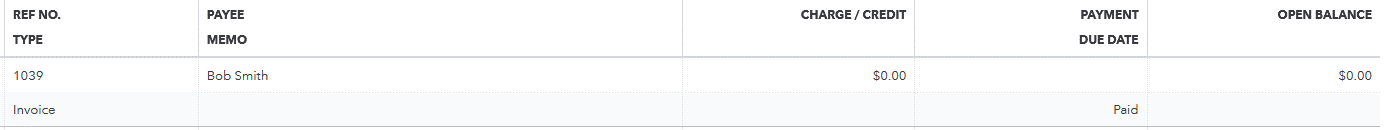

A zero-dollar entry will be posted to accounts receivable and will show as being “Paid.”

There you have it!

And if all goes as planned, you will not have to worry about entering any more transactions into QuickBooks Online for Bob Smith, at least for the next 12 months.

But, as with all things that are “automatic,” it is a good idea to keep an eye on your accounting to make sure everything is working as desired. Take special note of the “Unearned Subscription Revenue” balance sheet account. At no point do you want to see this account dropping into the negative. If it does, something went wrong.

Final Thoughts…

I recommend reconciling this “Unearned Subscription Account” monthly. This will depend on the number of prepaid clients you have and the dollar amounts charged. The problem is, “What do you reconcile this account to?” You will not be receiving a statement from the bank for this account.

Personally, I would create a spreadsheet to calculate the monthly ending balance for the “Unearned Subscription Account.” This may be something easier said than done. Perhaps this is something I can put together for another blog post.

Please feel free to leave your thoughts and questions in the comment section below.